The Native Token of the Leondrino Ecosystem

The Native Token of the Leondrino Ecosystem

From the very beginning, the XLEO was intended to shape the future of corporate finance and treasury management. Initially issued as a utility token within the Leondrino Ecosystem, the XLEO is now evolving into an asset-backed token – strategically positioned to serve as a bridge and a reserve currency in the growing world of enterprise-driven digital economies.

Be among the first to discover XLEO’s potential, now!

Take action before global and central banks begin building reserves in suitable digital assets.

To get all the details on available purchase options, please click here !!!

For further information on the XLEO Token, please read the whitepaper.

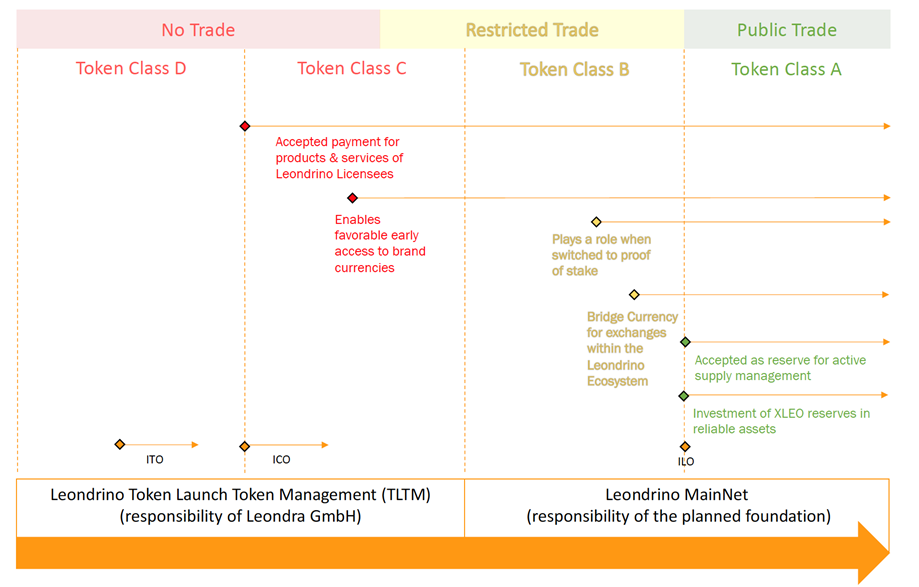

Role of XLEO

The Leondrino Ecosystem needs a stable bridge and reserve currency to enable a capital-efficient model of fractional reserve banking for corporate currencies. Moreover, it supports fast and fair transactions between different digital enterprise currencies.

Short-term Role

Utility Token for Leondrino Germany

- Accepted means of payment for services from Leondrino Germany (Leondra GmbH)

- Early and cheaper access to enterprise currencies

Long-term Role

Asset-referenced Currency

- Managed by the Leondrino Foundation

- Investment of reserves in other currencies, bonds and other investments

- “Supply Management Reserve” per enterprise currency is created via XLEO if the holding period is longer

Whitepaper

The XLEO Whitepaper gives you an overview of the Leondrino Ecosystem and its native token, the XLEO, and serves as a project description.

Please read through the XLEO Whitepaper and particularly the legal notices including the risk warning at the end of this document carefully before you decide on the purchase of XLEO tokens.

←

To read the XLEO Whitepaper, please click on the opposite picture.

Whitepaper

The XLEO Whitepaper gives you an overview of the Leondrino Ecosystem and its native token, the XLEO, and serves as a project description.

Please read through the XLEO Whitepaper and particularly the legal notices including the risk warning at the end of this document carefully before you decide on the purchase of XLEO tokens.

How to Invest

as Consumer / Retail Investor

Open a Leondrino Wallet, select the XLEO token and add it to your wallet. Follow the instructions to buy the XLEO token in the Leondrino Wallet.

Please note that the number of tokens that you can purchase via the Leondrino Wallet is limited depending on your user classification and the Leondrino Token Class in which the token is located.

Quick Guide:

- Open a Leondrino Wallet

- Maintain your user profile

- Identify yourself (Leondrino KYC Check)

- Add the XLEO to your wallet

- Click on BUY TOKEN

- Read and accept the Token Sale Terms

- Enter the desired amount and pay in Euro

- Receive XLEO credit note

- Done!

as Professional Investor

If you are a private investor or a wealth manager of a Family Office, VC or Token Fund, who intends to invest larger amounts, please approach us directly using our email address investor@leondrino.de.

You will receive information material and a contract proposal for a purchase agreement (SAFT – simple agreement on future token) and/or a contract proposal to sign a loan with the option to convert into token after they are available for public trade (also called Leondrino Convertible).

An attractive discount is offered depending on the size and date of your commitment.

Quick Guide:

- Contact Leondrino with “XLEO Token” as subject and specify the desired investment amount

- Conclude a Leondrino SAFT contract or a Leondrino Convertible

- Transfer the investment amount due

- Open a Leondrino Wallet

- Receive XLEO credit note

- Done!

Leondrino Wallet

Open your multi-currency wallet to access brand-specific benefits at checkout and to take advantage of enterprise currencies.

Build up a portfolio with enterprise currencies, manage it in your Leondrino Wallet on your own device and benefit from paying with branded Leondrino Currencies.

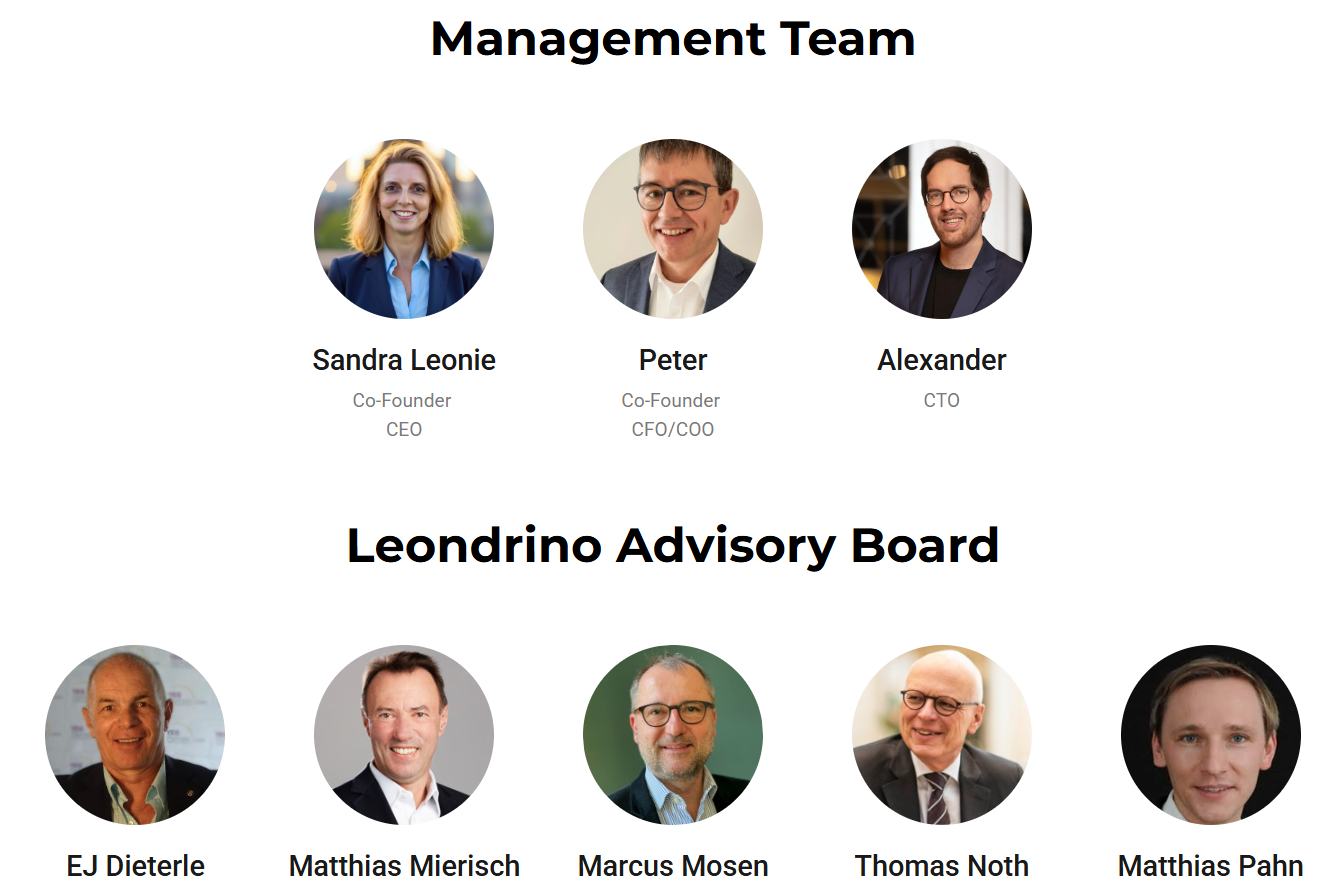

Who we are and What we are up to

Our vision is to enhance the stability and fairness of the financial system, making it accessible to everyone. We aim to achieve this by complementing it with competing digital currencies issued by corporations and corporate networks.

These currencies usually start as utility tokens and evolve into regulated stablecoins. Leondrino provides a pathway for corporations to issue their branded stablecoins – in Europe under MICA regulation.

The German licensee of Leondrino based in Berlin (Leondra GmbH) is one of the pioneers in the field of cryptocurrencies and offers its customers an innovative and unique ‘Currency Management-as-a-Service’; corporate customers can issue their own branded digital currencies and make them tradable.

Learn more about the milestones achieved, the Leondrino Standard and about our team.

Newsletter

Stay informed about Leondrino’s progress and when new branded Leondrino Currencies are available by subscribing to our newsletter.

FAQ

One major building block for realizing the Leondrino Vision is the Leondrino Ecosystem’s native currency — the XLEO. This token is designed to become a bridge and reserve currency in the long term.

Please read the XLEO Whitepaper to find all the information about the XLEO token and its role in the Leondrino Ecosystem.

The XLEO is more than just a digital currency: it serves as a fully collateralized reserve currency and a stable bridge between corporate currencies of Leondrino Token Class A. This interaction between XLEO and corporate currencies builds trust, strengthens stability, and enables the scalability of the entire Leondrino ecosystem.

The document „Leondrino Monetary Architecture“ outlines the unique role of the XLEO within the Leondrino ecosystem and how XLEO differs from the corporate currencies of Leondrino Token Class A.

With the fading trust in public treasuries, gold is regaining its significance as an investment alternative. At the same time, technological innovations are receiving increased attention. In particular, the development of stablecoins has the potential to fundamentally reshape the landscape of global finance.

Currently, stablecoins of the first generation are the primary focus. These are primarily characterized by their fixed peg to a national currency, with leading stablecoin providers typically ensuring a full reserve (100%) in the form of government bonds and cash. The US dollar currently plays a dominant role in this regard.

Leondrino of the highest quality (Leondrino Token Class A) are often considered by analysts as the logical next step in the evolution of stablecoins. But what distinguishes stablecoins of the next generation?

Definition of Second-Generation Stablecoins:

- In contrast to first-generation stablecoins, the stability of second-generation stablecoins is not based on a fixed peg to a national currency, but rather on the utility value of products and services within the issuer’s ecosystem.

- Second-generation stablecoins are distinguished by an acceptance obligation from the issuer, which is often extended to additional partners within the ecosystem as well as to external acceptance points.

- For each issuer, a unique monetary policy is defined, with governance either decentralized or monitored by an independent entity – as is the case with Leondrino. This structure also governs the management of the money supply.

- A fractional reserve system is implemented, taking into account the specific situation of each issuer and supported by a bridge and reserve currency. This enables efficient capital deployment while ensuring adequate liquidity.

- It is expected that large issuers of second-generation stablecoins will increasingly pursue and implement greater flexibility in the allocation of their reserves. In the case of Leondrino, the bridge and reserve currency XLEO will play a central role in the medium term, as it will manage the reserves of the highest category of corporate currencies (Leondrino Token Class A). Through increased flexibility in reserve allocation (Total Value Locked), a reduction in the dependency of these stablecoins on individual national currencies is achievable in the long term.

Second-generation stablecoins – particularly those issued by established corporations and growth companies following the Leondrino standard – provide a resilient approach to value storage and cross-border payments, complementing and operating independently of traditional fiat currency systems. Their integration into mass-market infrastructure can sustainably enhance the resilience of digital economic ecosystems at both regional and global scales.